Table Of Content

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals. A 5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan.

How Much Will My Monthly Mortgage Payments Be?

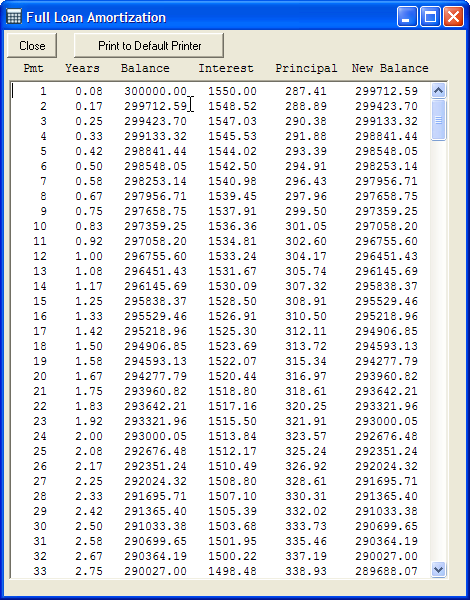

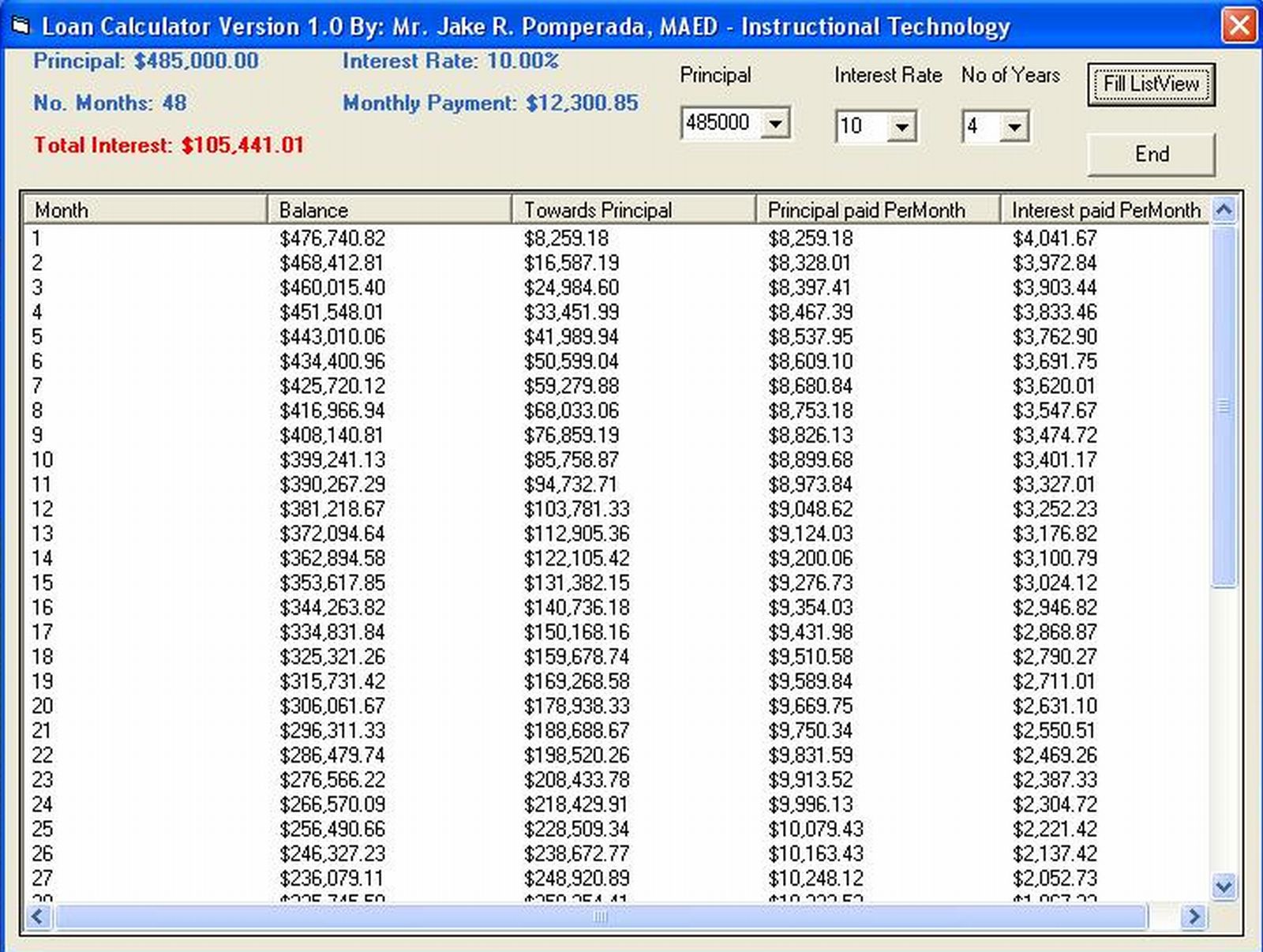

Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. In order to make an amortization schedule, you'll need to know the principal loan amount, the monthly payment amount, the loan term and the interest rate on the loan. Our amortization calculator will do the math for you, using the following amortization formula to calculate the monthly interest payment, principal payment and outstanding loan balance. Your loan term and interest rate will remain the same, but your monthly payment will be lower. With fees around $200 to $300, recasting can be a cheaper alternative to refinancing.

Enter City and State to get a custom rate

Idaho Mortgage Calculator - The Motley Fool

Idaho Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

The process of spreading your interest and principal payments over time is called amortization. When your loan is fully amortized, your loan balance reaches $0. This typically happens at the end of your term unless you make extra payments. For instance, if you want a lower monthly payment then you’ll want to choose a 30-year loan term. If you’re looking to pay less money in interest overall and can manage a higher monthly payment, you’ll want to choose a shorter loan term. The first two options, as their name indicates, are fixed-rate loans.

Calculate mortgage rates

The Loan term is the period of time during which a loan must be repaid. The larger your down payment, the more likely you are to qualify for lower interest rates. We recommend your down payment be at least 5% of the purchase price.

Unsecured Loans

You can select multiple durations at the same time to compare current rates and monthly payment amounts. Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment.

A financial advisor can aid you in planning for the purchase of a home. To find a financial advisor who serves your area, try SmartAsset's free online matching tool. Loans, grants, and gifts are three ways to supplement your savings for a down payment. Use this search tool to find and apply for financial assistance. On desktop, under "Interest rate" (to the right), enter the rate.

In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages. Mortgages are how most people are able to own homes in the U.S. SmartAsset’s mortgage calculator estimates your monthly mortgage payment, including your loan's principal, interest, taxes, homeowners insurance and private mortgage insurance (PMI). You can adjust the home price, down payment and mortgage terms to see how your monthly payment will change. Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term. This tool allows you to calculate your monthly home loan payments, using various loan terms, interest rates, and loan amounts.

Calculate your monthly mortgage payment

Click "Amortization" to see how the principal balance, principal paid (equity) and total interest paid change year by year. Private Mortgage Insurance is a special type of insurance policy, provided by private insurers, to protect the lender if you default on your loan. If your down payment is less than 20%, most lenders will require you to pay mortgage insurance. You’ll typically pay PMI until the mortgage’s LTV drops to 78% - meaning your down payment, plus the loan principal you’ve paid off, equals 22% of the home’s purchase price. Just like you have to carry insurance for your car, you have to carry insurance for your home. This protects you and the lender in case of a fire or other catastrophic accident.

How to calculate amortization with an extra payment

This can help you figure out if a mortgage fits in your budget, and how much house you can afford comfortably. If you’re new to homeownership, you may not realize that the loan amount isn’t the only factor to consider when determining how to calculate a mortgage payment. Let’s look at how mortgage payment calculators break down your monthly mortgage expenses. Enter your details below to estimate your monthly mortgage payment with taxes, fees and insurance.

When you figure out your total monthly household income, be sure to consider any recurring debt and expenses. Your mortgage lender may offer you a lower interest rate if you make a larger down payment. This is because a larger down payment means you’re less likely to default on your loan. Property taxes vary widely from state to state and even county to county.

However, with a 15-year fixed, you’ll have a higher payment, but will pay less interest and build equity and pay off the loan faster. The longer the term of your loan — say 30 years instead of 15 — the lower your monthly payment but the more interest you’ll pay. While it’s important to monitor mortgage rates if you’re shopping for a home, remember that no one has a crystal ball. It’s impossible to time the mortgage market, and rates will always have some level of volatility because so many factors are at play. An unsecured loan is an agreement to pay a loan back without collateral. Because there is no collateral involved, lenders need a way to verify the financial integrity of their borrowers.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. Today, both entities continue to actively insure millions of single-family homes and other residential properties. Loan start date - Select the month, day and year when your mortgage payments will start. When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Loan limits change annually and are specific to the local market.

If you don’t have enough saved for a 20% down payment, you’re going to pay more each month to secure the loan. Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments. Private mortgage insurance (PMI) is an insurance policy required by lenders to secure a loan that’s considered high risk. You’re required to pay PMI if you don’t have a 20% down payment and you don’t qualify for a VA loan.

Your estimated yearly payment is broken down into a monthly amount, which is stored in an escrow account. Your lender then pays your taxes on your behalf at the end of the year. The amount may fluctuate if your county or city raises the tax rate or if your home is reevaluated and increases in value. A 30-year fixed-rate mortgage is the most common type of mortgage. However, some loans are issues for shorter terms, such as 10, 15, 20 or 25 years. For example, for that same $200,000 house with a 4.33 percent interest rate, your monthly payment for a 15-year loan would be $1,512.67, but you would only pay $72,280.12 in interest.

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options. Typically, when you belong to a homeowners association, the dues are billed directly, and it's not added to the monthly mortgage payment.

Assuming an interest rate of 6.9% and a down payment under 20%, you’d need to earn a minimum of $150,000 a year to qualify for a $400,000 mortgage. That’s because most lenders’ minimum mortgage requirements don’t usually allow you to take on a mortgage payment that would amount to more than 28% of your monthly income. The mortgage payment estimate you’ll get from this calculator includes principal and interest.

No comments:

Post a Comment